Journal Entry For Asset Retirement Obligation . in this article, we’ll cover common journal entries for asset retirement obligations. if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. Us gaap rules asc 410 and asc 842 apply to. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. executive summary to provide businesses with guidance on when and how to recognize a liability for asset. asset retirement is an obligation under certain terms and conditions in leasing. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. Asset retirement obligations (aros) are legal obligations associated. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term.

from www.chegg.com

if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. executive summary to provide businesses with guidance on when and how to recognize a liability for asset. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. asset retirement is an obligation under certain terms and conditions in leasing. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. in this article, we’ll cover common journal entries for asset retirement obligations. Asset retirement obligations (aros) are legal obligations associated. Us gaap rules asc 410 and asc 842 apply to.

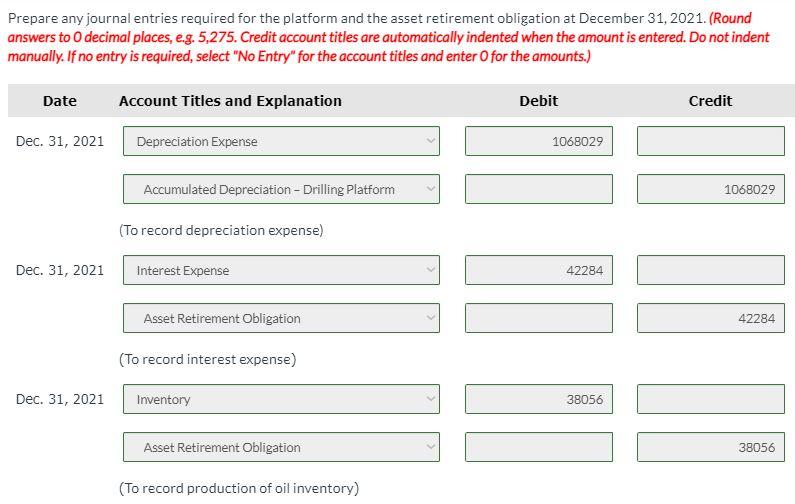

Prepare the journal entries to record the acquisition

Journal Entry For Asset Retirement Obligation executive summary to provide businesses with guidance on when and how to recognize a liability for asset. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. in this article, we’ll cover common journal entries for asset retirement obligations. executive summary to provide businesses with guidance on when and how to recognize a liability for asset. asset retirement is an obligation under certain terms and conditions in leasing. if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. Us gaap rules asc 410 and asc 842 apply to. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. Asset retirement obligations (aros) are legal obligations associated.

From www.youtube.com

Accounting for Costs (Asset Retirement Obligations) IFRS & ASPE (rev 2020 Journal Entry For Asset Retirement Obligation an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. in this article, we’ll cover common journal entries for asset retirement obligations. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. Us gaap rules asc. Journal Entry For Asset Retirement Obligation.

From www.chegg.com

Prepare the journal entries to record the acquisition Journal Entry For Asset Retirement Obligation in this article, we’ll cover common journal entries for asset retirement obligations. executive summary to provide businesses with guidance on when and how to recognize a liability for asset. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. Asset retirement obligations (aros) are legal obligations associated. asset. Journal Entry For Asset Retirement Obligation.

From www.youtube.com

Asset Disposal (Asset realisation) Journal Entries Steps with Examples YouTube Journal Entry For Asset Retirement Obligation in this article, we’ll cover common journal entries for asset retirement obligations. asset retirement is an obligation under certain terms and conditions in leasing. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. executive summary to provide businesses with guidance on when. Journal Entry For Asset Retirement Obligation.

From www.chegg.com

Solved Prepare the journal entries to record the acquisition Journal Entry For Asset Retirement Obligation The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. asset retirement is an obligation under certain terms and conditions in leasing. in this article, we’ll cover common journal entries. Journal Entry For Asset Retirement Obligation.

From www.youtube.com

Asset Retirement Obligations ARO Arabic YouTube Journal Entry For Asset Retirement Obligation a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the. Journal Entry For Asset Retirement Obligation.

From www.chegg.com

Prepare any journal entries required for the depot Journal Entry For Asset Retirement Obligation in this article, we’ll cover common journal entries for asset retirement obligations. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. Us gaap rules asc. Journal Entry For Asset Retirement Obligation.

From www.investopedia.com

Asset Retirement Obligation Definition and Examples Journal Entry For Asset Retirement Obligation an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. Us gaap rules asc 410 and asc 842 apply to. The credit will increase the aro liability. Journal Entry For Asset Retirement Obligation.

From www.superfastcpa.com

Common Journal Entries for Asset Retirement Obligations Journal Entry For Asset Retirement Obligation if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. executive summary to provide businesses with guidance on when and how to. Journal Entry For Asset Retirement Obligation.

From quizspattering.z21.web.core.windows.net

How To Calculate Aro Journal Entry For Asset Retirement Obligation Us gaap rules asc 410 and asc 842 apply to. if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. executive summary. Journal Entry For Asset Retirement Obligation.

From www.youtube.com

Tutorial Asset Retirement Obligation (Intermediate Financial Accounting II, Tutorial 13 Journal Entry For Asset Retirement Obligation an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. in this article, we’ll cover common journal entries for asset retirement obligations. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. asset retirement is. Journal Entry For Asset Retirement Obligation.

From desklib.com

Calculation of Depreciation, Journal Entries for Asset Retirement Obligation, Gross Profit Journal Entry For Asset Retirement Obligation Asset retirement obligations (aros) are legal obligations associated. executive summary to provide businesses with guidance on when and how to recognize a liability for asset. in this article, we’ll cover common journal entries for asset retirement obligations. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. if. Journal Entry For Asset Retirement Obligation.

From desklib.com

The Depreciation Amount for Asset Journal Entry For Asset Retirement Obligation executive summary to provide businesses with guidance on when and how to recognize a liability for asset. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. Asset retirement obligations (aros) are legal obligations associated. The credit will increase the aro liability each year until. Journal Entry For Asset Retirement Obligation.

From fundsnetservices.com

Journal Entry Examples Journal Entry For Asset Retirement Obligation if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. in this article, we’ll cover common journal entries for asset retirement obligations. an asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the. Journal Entry For Asset Retirement Obligation.

From desklib.com

Calculation of Depreciation, Journal Entries for Asset Retirement Obligation, Gross Profit Journal Entry For Asset Retirement Obligation in this article, we’ll cover common journal entries for asset retirement obligations. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. executive summary to provide businesses with guidance on when and how to recognize a liability for asset. if you take a look at the example journal. Journal Entry For Asset Retirement Obligation.

From www.youtube.com

Accounting for Defined Benefit Pension Plans under ASPE (rev 2020) YouTube Journal Entry For Asset Retirement Obligation in this article, we’ll cover common journal entries for asset retirement obligations. executive summary to provide businesses with guidance on when and how to recognize a liability for asset. asset retirement is an obligation under certain terms and conditions in leasing. Asset retirement obligations (aros) are legal obligations associated. a conditional asset retirement obligation is a. Journal Entry For Asset Retirement Obligation.

From www.universalcpareview.com

Accounting for Asset Retirement Obligations Universal CPA Review Journal Entry For Asset Retirement Obligation Us gaap rules asc 410 and asc 842 apply to. if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. executive summary. Journal Entry For Asset Retirement Obligation.

From www.awesomefintech.com

Asset Retirement Obligation Defined AwesomeFinTech Blog Journal Entry For Asset Retirement Obligation if you take a look at the example journal entry for year 1, the debit is to accretion expense and the credit is to asset retirement obligation. a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity where the timing. an asset retirement obligation is the liability for the removal of property,. Journal Entry For Asset Retirement Obligation.

From www.slideserve.com

PPT Asset Retirement Obligations ASC 41020 PowerPoint Presentation, free download ID6816059 Journal Entry For Asset Retirement Obligation Us gaap rules asc 410 and asc 842 apply to. asset retirement is an obligation under certain terms and conditions in leasing. Asset retirement obligations (aros) are legal obligations associated. The credit will increase the aro liability each year until it reaches $250,000 at the end of year 5. if you take a look at the example journal. Journal Entry For Asset Retirement Obligation.